Az Withholding Form 2025. Arizona’s income tax for the year 2025 (filed by april 2025) will be a flat rate of 2.5% for all residents. What should the employer do with the.

Withholding forms, payment vouchers : The standard deduction for a single filer in arizona for 2025 is $ 14,600.00.

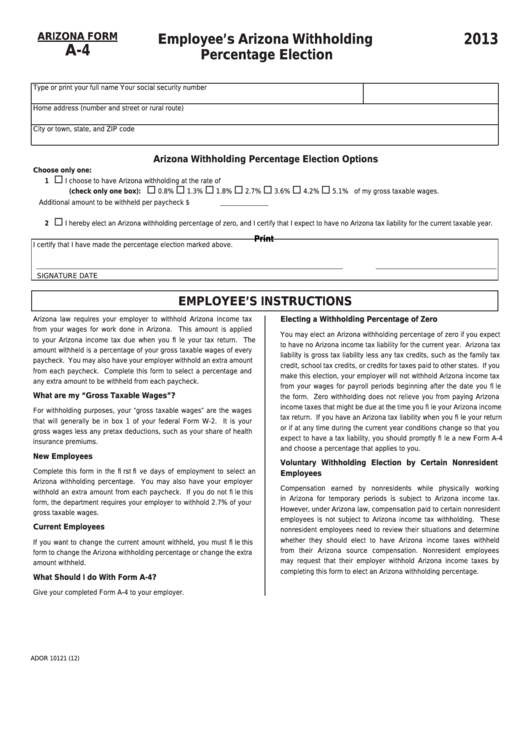

Arizona’s income tax for the year 2025 (filed by april 2025) will be a flat rate of 2.5% for all residents.

To compute the amount of tax to withhold from compensation paid to employees for services performed in arizona, all new employees subject to arizona income tax.

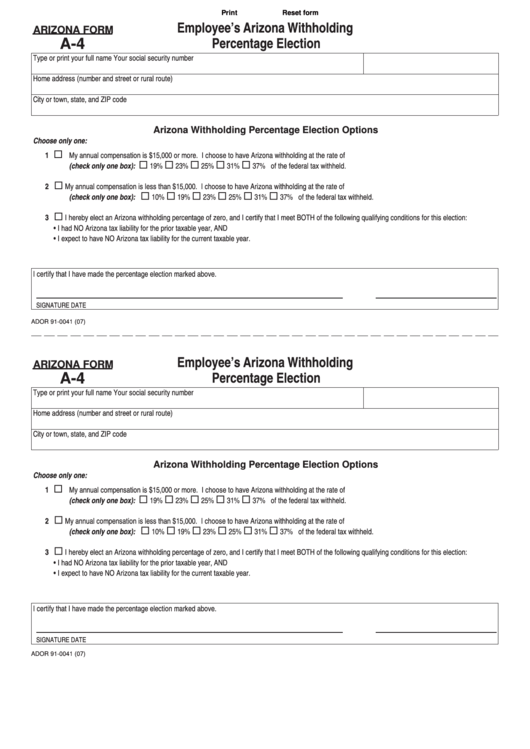

Fillable Arizona Form A4 Employee'S Arizona Withholding Percentage, Arizona’s employees have new tax withholding options. The arizona state tax calculator (azs tax calculator) uses the latest federal tax tables and state tax tables for 2025/25.

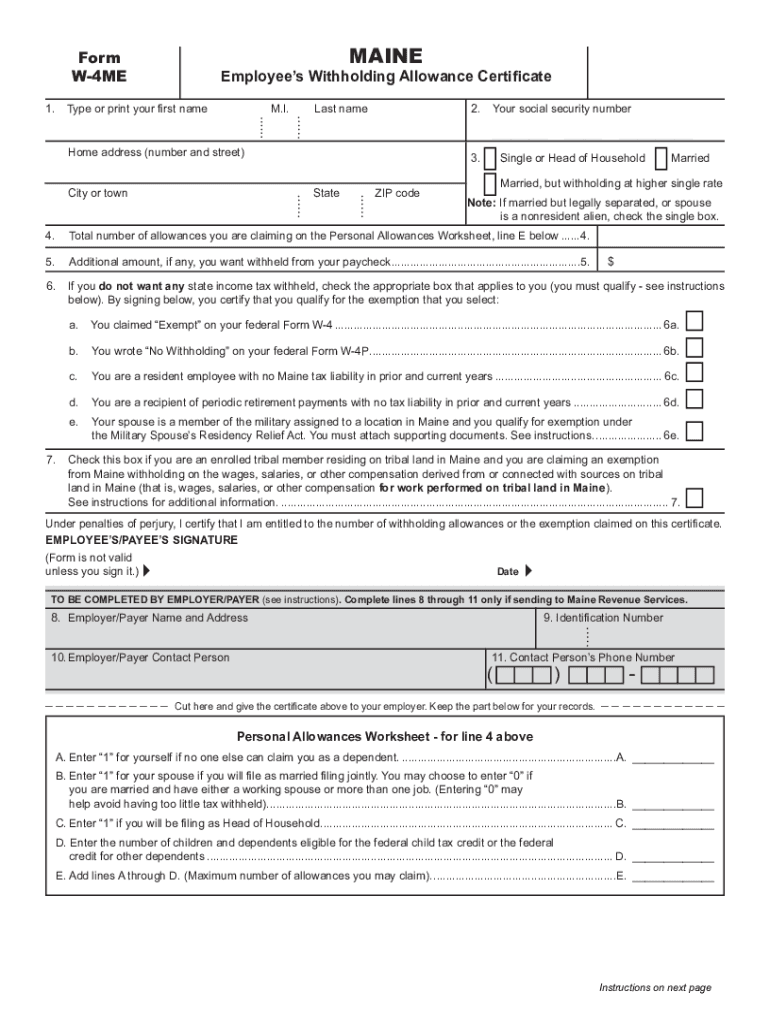

W4 20232024 Form Fill Out and Sign Printable PDF Template airSlate, Arizona single filer tax tables. Tax rates used on arizona’s withholding.

Fillable Arizona Form A4 Employee'S Arizona Withholding Percentage, To estimate your tax return for 2025/25, please select. Arizona flat tax for 2025 and beyond.

IRS Form W 4S Download Fillable PDF Or Fill Online Request For Federal, Arizona’s withholding rates are to decrease for 2025. Tax rates used on arizona’s withholding.

Printable State Tax Forms, Reporting wages and paying unemployment insurance taxes. The arizona department of revenue (azdor) announced on november 1, 2025, arizona’s employees have new tax withholding options.

Calendario De Bolsa 2025 W4 Withholding Tax IMAGESEE, The arizona department of revenue will follow the internal revenue service (irs) announcement regarding the start of the 2025. Tax rates range from 0.5% to 3.5%.

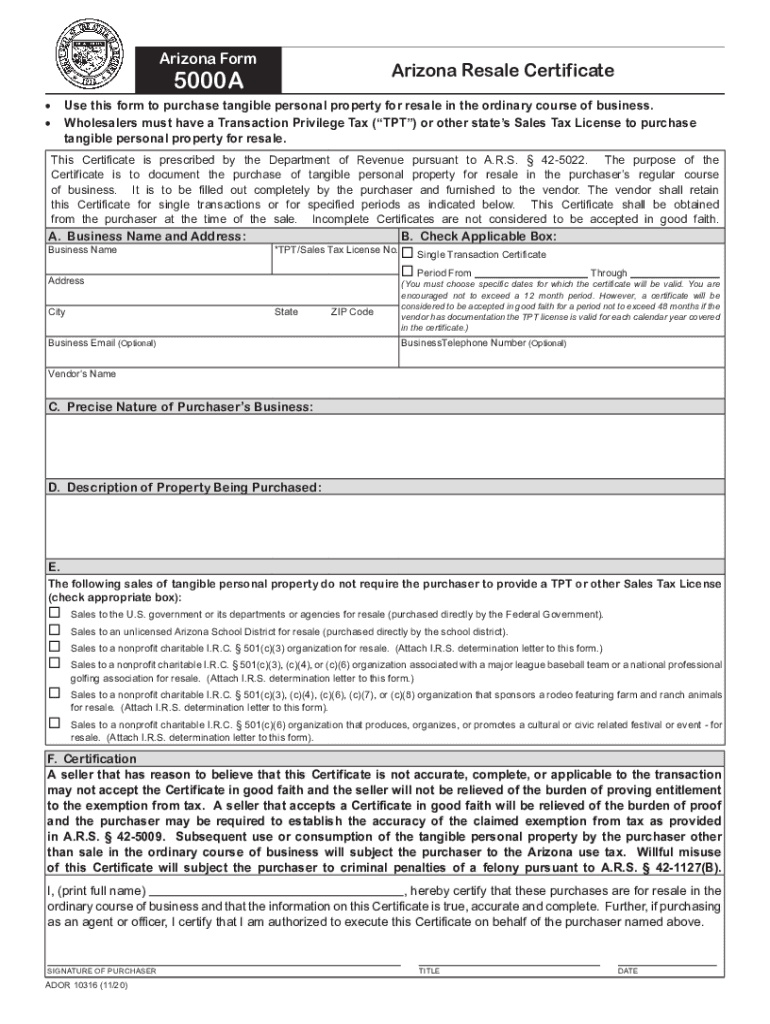

20202024 AZ Form 5000A Fill Online, Printable, Fillable, Blank pdfFiller, What should the employer do with the. Arizona’s withholding rates are to decrease for 2025.

Form A1r Arizona Withholding Reconciliation Tax Return 149, 20 rows withholding forms : Arizona’s individual income tax withholding form (arizona.

W4 Form Employee's Withholding Certificate Instructions pdfFiller Blog, You can use your results. To compute the amount of tax to withhold from compensation paid to employees for services performed in arizona, all new employees subject to arizona income tax.

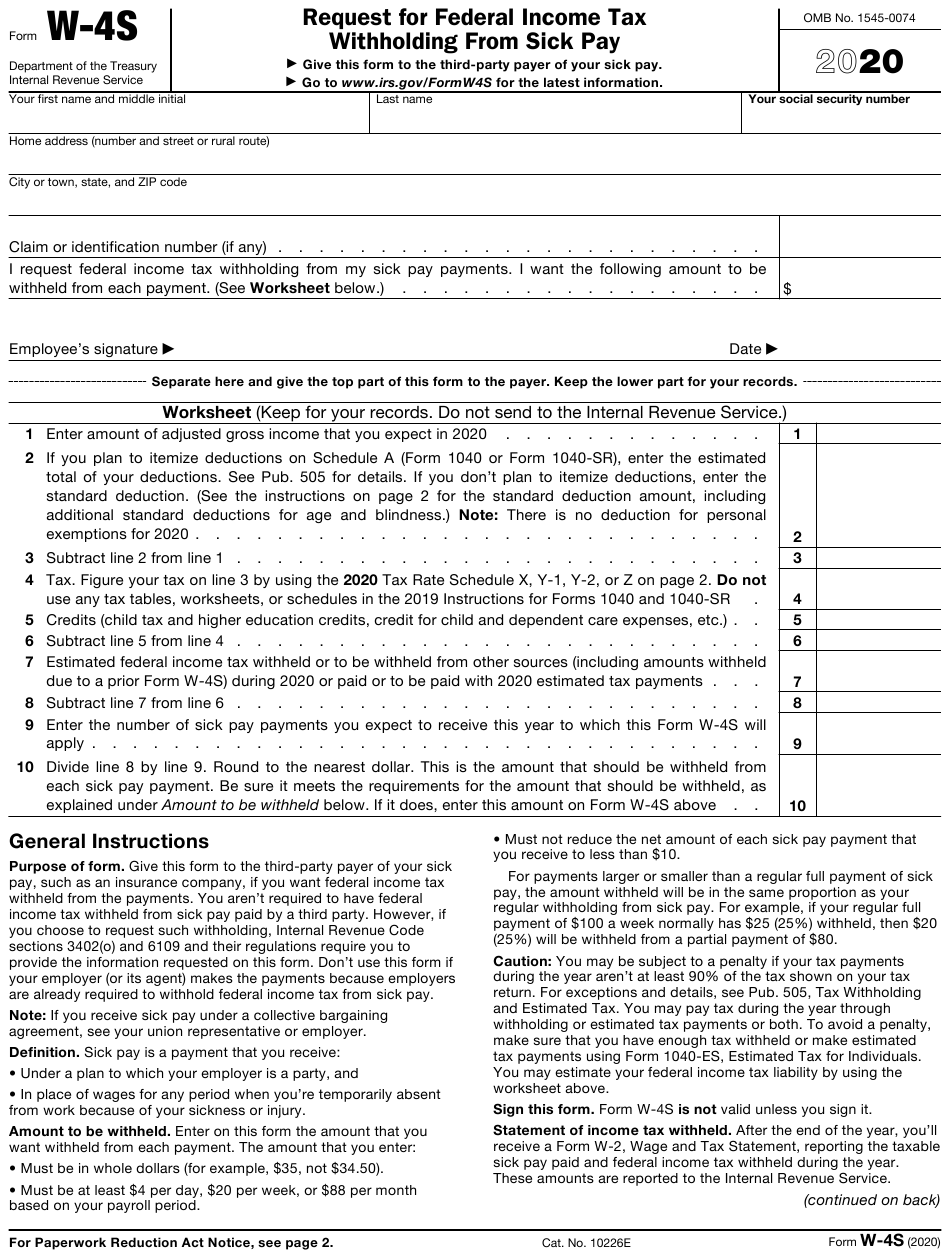

IRS Form W4 Download Fillable PDF or Fill Online Employee's, Arizona’s employees have new tax withholding options. The arizona department of revenue will follow the internal revenue service (irs) announcement regarding the start of the 2025.