California Income Tax Calculator 2025. For the 2025 tax year, dependents can claim either $1,250 or their earned income plus $400, whichever is greater. Ca tax calculator 2025 | california tax calculator.

Updated for 2025 with income tax and social security deductables. California married (joint) filer standard deduction.

how do i cancel my california estimated tax payments?, First, we calculate your adjusted gross income (agi) by taking your total household income and reducing it by certain items such as contributions to your 401 (k). Qualifying surviving spouse/rdp with dependent child.

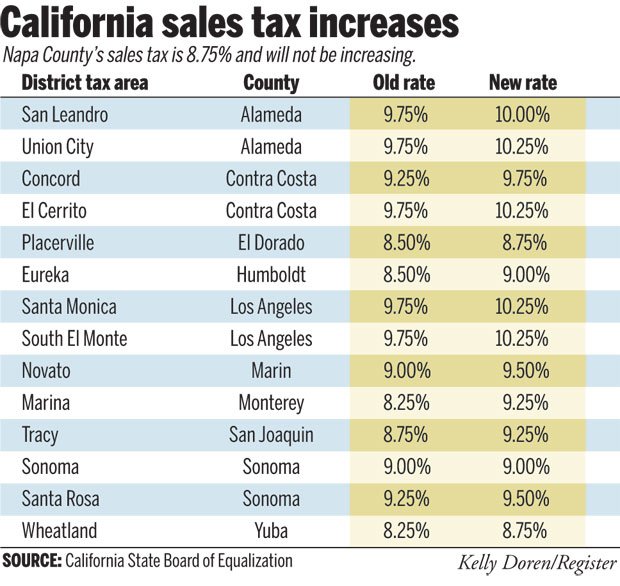

New Sales Tax Rates California 2025 Driving Test PELAJARAN, Calculate your income tax, social security. Year month biweekly week day hour.

Covered California Limits, Eligible taxpayers with a household adjusted gross income (agi) of $79,000 or less can file their federal tax returns for free online. Ap world war ii veteran olin pickens, of nesbit, miss., who served in the u.s.

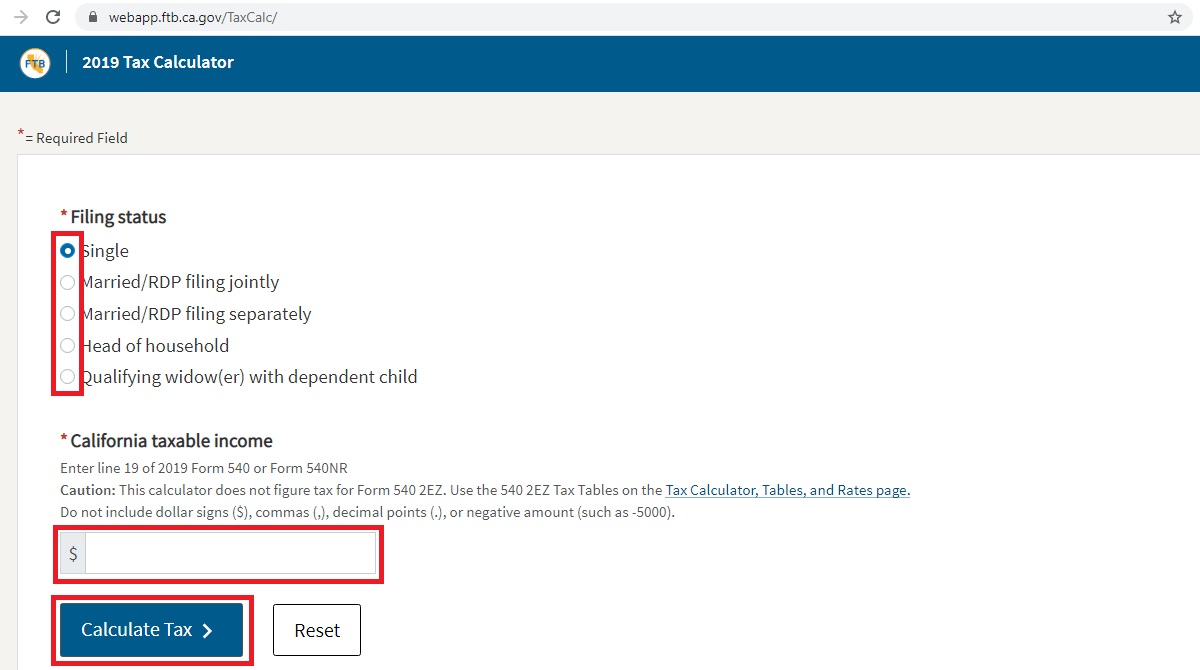

California Tax Brackets 2025 In 2025 Tax Brackets Tax, If your taxable income was $100,000 or less, use the tax table on the california franchise tax board's website to figure taxes owed instead. * california taxable income enter.

California Tax Calculator Index CFD, Learn how to estimate your income tax with easy steps focusing on taxable income and understanding the results. Ca tax calculator 2025 | california tax calculator.

California Tax Calculator 2025 2025, Eligible taxpayers with a household adjusted gross income (agi) of $79,000 or less can file their federal tax returns for free online. This equates to an average tax rate of.

California Federal Tax Rate 2025 yabtio, Qualifying surviving spouse/rdp with dependent child. The free online 2025 income tax calculator for california.

Ranking Of State Tax Rates INCOBEMAN, Calculate your annual salary after tax using the online california tax calculator, updated with the 2025 income tax rates in california. California income tax calculator estimate your california income tax burden updated for 2025 tax year on feb 16, 2025

How much is taxes in California Unemployment Gov, Qualifying surviving spouse/rdp with dependent child. The salary tax calculator for california income tax calculations.

California Tax Brackets 2025 Q2023H, College is an expensive undertaking. Vanguard municipal money market fund (vmsxx) taxes can eat into the overall returns investors can expect from a money market fund.

For the 2025 tax year, dependents can claim either $1,250 or their earned income plus $400, whichever is greater.